Trading Psychology Basics

There’s a lot of materials on trading psychology out there. A lot of it is good, some of it is bad, some of it is really bad. But at the end, the big question is whether or not it works.

I have a big problem with this approach to education on trading psychology. The big problem I have is that you can talk all day about cognitive biases, emotional regulation, human behavior, or even evolutionary theory. However, if the fundamental trading process is bad, then it doesn’t matter what the psychology is doing. The “good” psychology is built on a bad foundation.

What’s interesting is that if the trading process is good, then there isn’t a lot of psychological processing that is needed.

I believe that trading psychology can’t be discussed in a vacuum. Rather, it needs to be discussed in context of the trading process you are using.

So what is a bad trading process?

Nivida (NVDA) went up and everyone is buying, so I will buy too.

GME is going to the Mooon!!! I need to buy.

My stock is down 50%, I don’t know what to do.

Basically, copying others without understanding the fundamental drivers is a bad process. That’s how 90% of people think. How does one fix that on a psychological level?

What’s a good trading process? One that is consistently profitable. But where do you find such a process? You would look for consistently profitable traders, preferably professional ones that have traded other people’s money.

Who traded other people's money profitably?

learn moreBut I don’t want to get too deep into that. Rather, I want to point out that there is a relationship between your trading psychology and your process.

Once you’ve gotten a good process, one that produces consistently profitable results, it’s a matter of execution. When you have to execute a good process, that is when your psychology can do the most damage.

Who traded other people's money profitably?

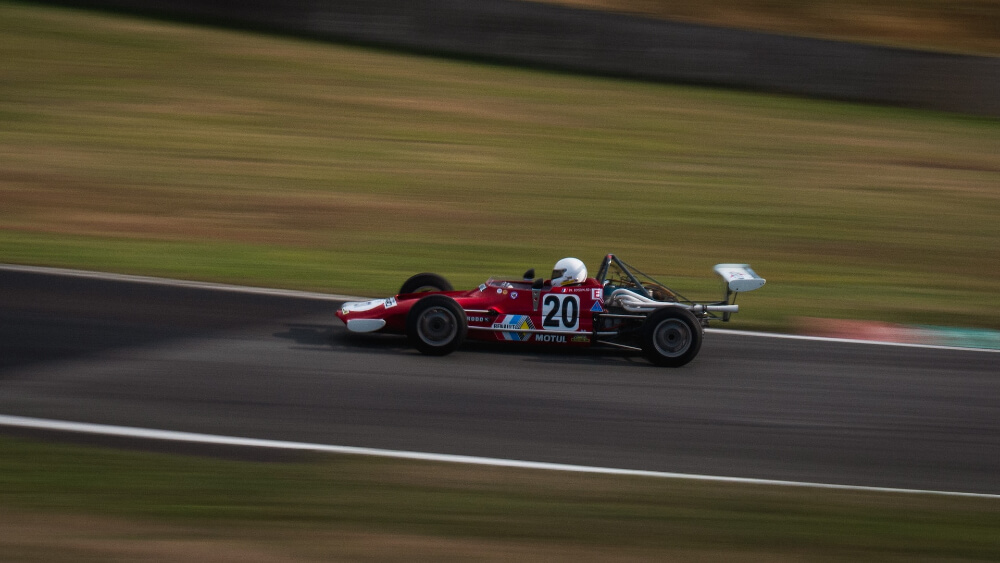

learn moreImagine you have a crappy car. Poor gas milage, almost falling apart, can’t go faster than 50 mph without causing problems, the seat is uncomfortable. It doesn’t matter how much time you spend going to driving lessons, or practicing how to drive. You’re never going to win a formula 1 racing event. You could be the best race car driver in the world, the car matters.

Imagine you have the best car in the business. It’s highly efficient, turns on a dime. It works perfectly and gets the job done.

I’ve found that a lot of trading psychology materials talk about you as the driver (as they should) but they speak nothing about the car. And if they know nothing about the car, how much can they truly help you, the driver?

So the truth is that the basics of trading psychology has nothing to do with psychology. It has everything to do with your trading process. Once you have a solid trading process, the only thing left that hinders your success is yourself. That’s when trading psychology comes into play.

Your trading psychology might be the deciding factor for your next BIG win or your next BIG loss.

You'll never know when a guide might come in handy. Get notified when new guides come out below.