Trading Vs. Investing

It is surprising how many people use the word “trading” when they really mean “investing” and vice versa. It makes sense. If you buy a stock and sell it, that’s a trade. You want to invest to grow your money. What better way to do that than to buy and sell an asset? In other words, “trade” the asset.

However, the distinction between trading versus investing is an important one. Without truly understanding the difference, you won’t be in the right frame of mind to make the right decisions.

How You Make Money

The difference between trading and investing is based on how you want to make money. Do you want to make money from changes in perception about an asset? Or do you want to make money from compound interest over long periods of time?

If it’s the first, that’s a trade. However, if it’s the second, that’s an investment.

The truth is that we often confuse ourselves in the process of making a purchase from the beginning.

Let’s say you did a ton of research on a stock. You’ve figured out that it is heavily undervalued. You decide to buy it. The stock then goes your way and the price triples over the course of 6 months. Great! You then decide to sell it because you believe there are better opportunities elsewhere.

Was that a trade or an investment?

What would change your answer? What if it tripled over the course of 1 year? Or 10 years? What if it only went up 10%? What if the stock went down? What would you do? What makes this a trade versus an investment?

It heavily depends on how you wanted to make money in the first place.

Looking at an Example

Let’s say you purchased the stock because you believed there would be earnings that the company would re-invest, making the company stronger and exponentially growing its earnings potential. With this logic, it makes sense to hold the stock forever as long as the fundamental exponential business model is intact.

For example, Apple created a system where they created a phone that had the ability to install apps. Apps would be created by developers and purchased by customers. Money coming from both developers and customers would help to fund this ecosystem. If the ecosystem continues to grow, it has a built in moat (a.k.a monopoly) as the only platform that can be used is Apple’s phone. Investment in this system will make it stronger, allowing Apple to have stronger bargaining power in the future. This is strong enough to get apple in trouble with the EU for monopolistic practices but that’s a story for another day.

Apple hit with landmark $2 billion EU antitrust fine

CNN

In the above scenario, if you believed in the Apple ecosystem way back then, it would make sense for you to hold Apple indefinitely until this ecosystem is under threat. Now that governments are beginning to push back on Apple for concerns of anti-trust and monopolistic practices, some investors are concerned and Apples stock price has taken a hit compared to the others in the Magnificent 7 (or FAANG).

This is fundamentally the psychology of the Investor.

What about a Trader?

So What’s Trading?

Let’s say you purchase Apple for similar reasons above. What’s stopping you from buying it at a low price, selling it in the future at a higher price and calling it a trade? You made money. Why be so nitpicky?

Let’s take a look at Apple’s stock price over the course of a decade:

It’s practically a straight line up! Anything that goes from the bottom left to the top right makes money. The longer you hold, the more money you make. What’s there’s not to love? Why would you ever want to “trade” anything? Just buy and hold forever.

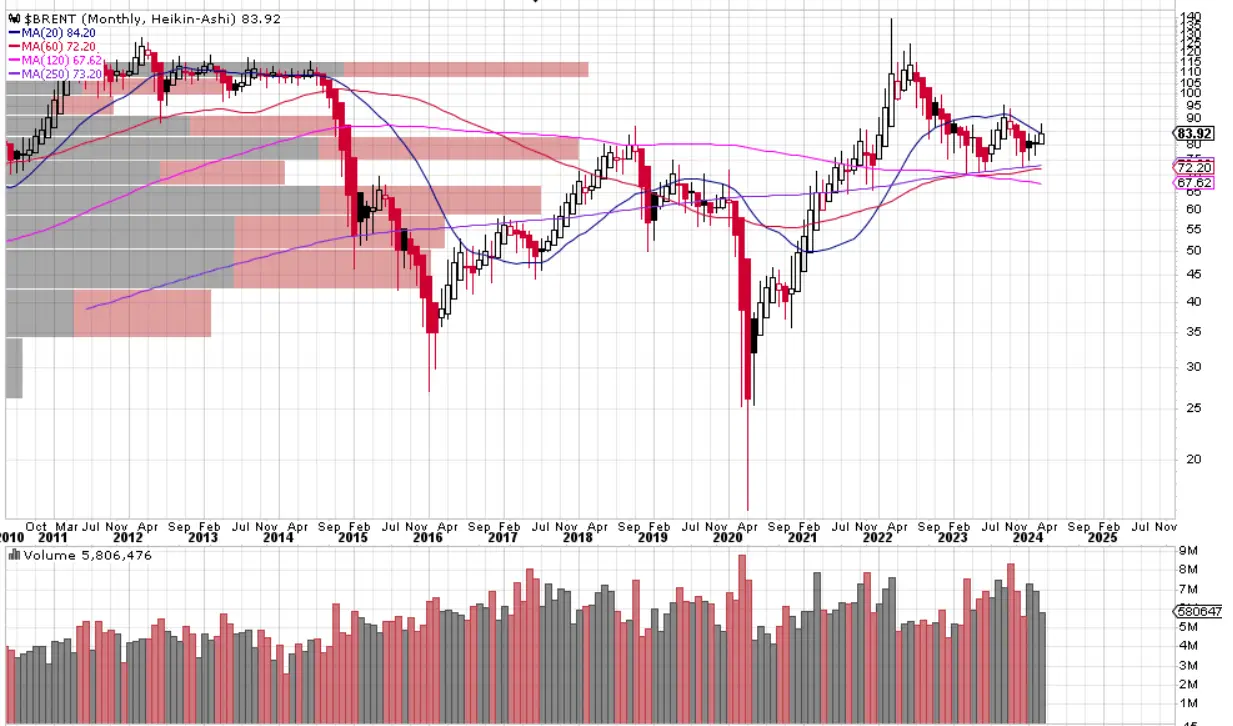

It’s true that Apple is a great investment (especially in hindsight). However, let’s take a look at something else over the same time period. How about Oil:

Is this something you’d want to invest in from 2010? How much money would you have made? What’s going on?

The strategy for Apple is to buy and hold because you are making exponential gains from the business model they set up. That is why Apple’s price was able to go from the bottom left to the top right, almost easily. That is the power of compound interest.

However, Oil doesn’t have the same exponential properties. Oil didn’t go from the bottom left to the top right. It went up and down for all sorts of reasons!

What are those reasons?

That’s the point.

That’s trading.

Returns of Trading vs. Investing

At first glance, it may look like I’m advocating that everyone just invest, hold Apple forever, and make a fortune. Forget about trading.

That’s not exactly the point I’m trying to make.

Let’s say you purchased Apple in the beginning of 2011 for around $10 a share. By today’s price of $175, you would have had a 1,650% Profit

Let’s say you purchased Oil around the same time for $90 a barrel. At today’s price of $84, you would have lost around 7%. However, if you would have traded Oil PERFECTLY, buying at the lows and shorting at the highs, you would have made the following return:

- Bought at $90 in Jan 2011, Sold at $120 Mar 2012– 33%

- Sold at $120 in Mar 2012, Bought to Cover at $35 Jan 2016 – 70%

- Bought at $35 Jan 2016, Sold at $80 Oct 2018 – 129%

- Sold at $80 Oct 2018, Bought to Cover at $25 Apr 2020 – 69%

- Bought at $25 Apr 2020, Soldat $115 June 2022 – 360%

If you were to compound these returns, it would amount to 4,025%!!!

Of course, those types of returns are astronomical because they represent perfect trading. You perfectly buy at the lows and short at the highs. You will not likely see those gains. But will you necessarily see those gains with Apple?

Let’s look at IBM, another popular stock at the time Apple was around.

If you purchase IBM in 2011 for around $85, the stock would be worth $190 today for a 123% return after 13 years. Not as great as Apple. Exactly how many stocks have a return like Apple over a decade? Not many. I think we call them FAANG or the Magnificent 7. Can you pick them? Maybe.

However, what happens if you trade IBM? Could your returns be better?

I’m not saying that the turns of trading are always greater than investing. There’s a lot that goes to trading. I’m saying the ways investing makes money is very different from the ways trading makes money.

Buying and Selling for Different Reasons

Making 1,650% return by buying and holding Apples requires you to identify Apple’s engine for creating compound and exponential growth through a superior business model.

Making 4,025% in trading Oil requires you to understand the reasons why oil prices fluctuated so much and to have the ability to change course when needed. It requires you to keep track of various macroeconomic factors and make some good decisions with regards to various geopolitical events.

The biggest problem is that most people don’t really have actual “reasons” for buying and selling things. As a result, they get confused and commit one of these sins:

- Having reasons for buying a stock that are in line with investing, and then buying and selling the stock because you get FOMO or get scared

- Buying a stock because of a change in circumstances that are temporary, and then holding onto the trade forever because you think “buy and hold” strategies prevents you from losing money

- Having no actual reason to buy or sell an asset outside a tip that a friend gave you. Then, you add more or close the trade for even more random reasons.

Your Personal Psychology

This is where you need to reflect on yourself and ask, “Am I a trader or am I an investor?”

Without answering that fundamental question, you won’t even know what you want to research!!

If you’re a trader, it means you’ll want to understand the reasons why a stock is trading at the current price. It can be for macroeconomic reasons, industry specific reasons, company specific reasons, political reasons, or other reasons. You need to get a pulse of the market. Once you understand the psychology of why the market is pricing the stock at the current price, you’ll want to have a sound reason for whether the trend will continue or reverse. You’ll map your trade accordingly.

If you’re an investor, you’ll want to get a better sense of management’s thought process, how they handle challenges in the world. You’ll want to understand how they’re structuring the business model and how they view their own business model in light of changes in the world. Once you have a solid understanding of the business model and management’s execution, you’ll buy and hold for as long as the business model makes sense and management can execute on that business model.

Inevitably, the information for trading and investment overlaps. You’ll need to understand business models as a trader just as much as you need to understand the macroeconomic landscape as an investor. However, the reasons for going into the trade are different and, therefore, the reasons for exiting the trade are different as well.

You’ll want to ask yourself which appeals more to you. And once you’ve decided, you’ll want to begin to build processes that algin with the way you like to think. If you start trading when your mentality is an investor, you’ll exit your positions unnecessarily. And if you’re investing when your mentality is a trader, you’ll hold positions longer than you should.

I hope you found that helpful. Happy Trading!

Your trading psychology might be the deciding factor for your next BIG win or your next BIG loss.

You'll never know when a guide might come in handy. Get notified when new guides come out below.